Ans. GST came into force on 1st July, 2017 amalgamating various central and state level indirect tax laws

Ans. Every supplier having annual aggregate turnover of more than Rs. 20 lakhs of goods or services. Where supplier is engaged only in intra-state supply of goods, then registration required if turnover exceeds Rs. 40 lakhs. If supplier is engaged in supply of only those goods or services which are not chargeable to GST, then registration is not required. In some cases, registration may be required irrespective of turnover.

Ans. Yes, registration can be applied voluntarily even if aggregate turnover is below the prescribed limit. On obtaining voluntary registration, all provisions of GST Act shall be applicable to such supplier as they are applicable to any other person.

Ans. Yes, the supplier can collect GST from customers only after registration.

Ans. Yes, the registration must be applied within 30 days of becoming liable for registration. Casual Taxable Persons and Non-Resident Taxable Persons need to apply for apply at least 5 days before commencement of business.

Ans. Typical requirements include PAN card, Aadhar Card, Address Proof, Bank account details, Registration Certificate and Letter of Authorization.

Ans. GSTIN stands for Goods and Services Tax Identification Number. GSTIN is allotted post registration and is used for making tax payments, filing returns etc.

Ans. Composition scheme is available for small and medium businesses having turnover of goods or turnover from restaurant service upto Rs. 1.50 crores. In case of other services, maximum turnover can be Rs. 50 lakhs. A composition taxpayer is not allowed to make inter-state supply and is also not eligible to claim input tax credit on purchases done by it. The tax rate for manufacturers and traders is 1% and for restaurant service providers, it is 5%. In case of other services, tax rate is 6%. The composition tax is not collected from the buyers and is paid by the supplier. Option to pay tax under composition scheme must be intimated before the beginning of financial year. However, withdrawal from composition scheme can be done at any time during the year.

Ans. No, state-wise registration is done under GST. The first two digits of the GSTIN represent state code. Separate Registration is required in each state in which the organization is maintaining a place of business and carrying on its operations.

Ans. Yes, registration can be obtained for each business place within one state whether all such business places are carrying on same business or different lines of businesses.

Ans. In case of inter-state transactions, Integrated Goods and Services Tax (IGST) is charged. In case of intra-state transactions, Central Goods and Services Tax (CGST) and State Goods and Services Tax (SGST) are charged. For example, if an item attracts 18% GST rate, then IGST will be charged at the rate of 18% in case of inter-state transactions and 9% CGST plus 9% SGST will be charged in case of intra-state transactions.

Ans. HSN stands for Harmonised System of Nomenclature and SAC stands for Service Accounting Code. HSN is used for goods and SAC is used for services. These are used for classification and identification of goods or services. These are required to be mentioned on tax invoice upto 4 digits if turnover is less than or equal to Rs. 5 crores and 6 digits when turnover is more than Rs. 5 crores.

Ans. Input Tax Credit (ITC) represents the tax paid by the supplier on purchases and input services which can be deducted while discharging the output tax liability. ITC is claimed by the supplier on a self-declaration basis in GSTR-3B and should not exceed 105% of ITC appearing in GSTR-2B/2A. In GST, ITC is allowed for inputs, input services and capital goods used in the course of or furtherance of business. ITC on personal expenditure can’t be claimed. Also there are certain good and services on which ITC can’t be claimed even though they are used for the purposes of business like food and beverages, motor vehicles, free samples, construction material etc. ITC can be claimed only if the outward sale made using those inputs or input services or capital goods is not exempt under GST.

Ans. In simple terms, aggregate turnover means aggregate value of all taxable supplies (excluding inward supplies on which tax is payable on reverse charge basis), exempt supplies, export of goods or services or both and inter-state supplies persons having same PAN to be computed on all India basis excluding the amount of tax. Thus, while deciding the need for registration, exempt and non-taxable supplies also need to be taken into account while calculating the amount of turnover.

Ans. Reverse charge means a situation where the liability to pay tax is on the recipient of goods or services instead of the supplier of goods or services. Such liability can be discharged only by payment in cash. ITC can’t be used for paying tax under Reverse Charge.

Ans. Casual taxable person means a person who occasionally undertakes transactions involving supply of goods or services whether as a principal, agent or in any other capacity, in a state or Union Territory where he has no physical presence.

Non-resident taxable person means a person who occasionally undertakes transactions involving supply of goods or services whether as a principal, agent or in any other capacity, but who has no fixed place of business or residence in India.

Ans. Exempt supplies consist of:

- Nil-rated supplies attracting 0% tax rate as per GST schedules

- Supplies which are wholly exempt under Section 11 of CGST Act or Section 6 of IGST Act

- Non-taxable supplies which are outside the purview of GST namely High-Speed Diesel, Motor Spirit (Petrol), Petroleum Crude, Natural Gas and Aviation Turbine Fuel.

ITC is not available in respect of such supplies.

Ans. Zero-rated supplies refer to export of goods or services or supply made to a SEZ developer or SEZ unit. The supplier has the option not to pay IGST on such supply by making supply under Bond/Letter of Undertaking and later claim refund of Accumulated ITC on inputs or input services used in making such supplies. Alternatively, supplier can pay IGST on such supply and later get refund of IGST paid on such supply.

Ans. GST return is basically a statement showing various transactions of your business during a particular tax period. The main components of a GST Return include Sales, Purchase, Output Tax and Input Tax Credit.

Ans. In case of composition taxpayer, CMP-08 which is a statement and challan needs to filed on a quarterly basis and annual return in form GSTR-4 need to be on an annual basis.

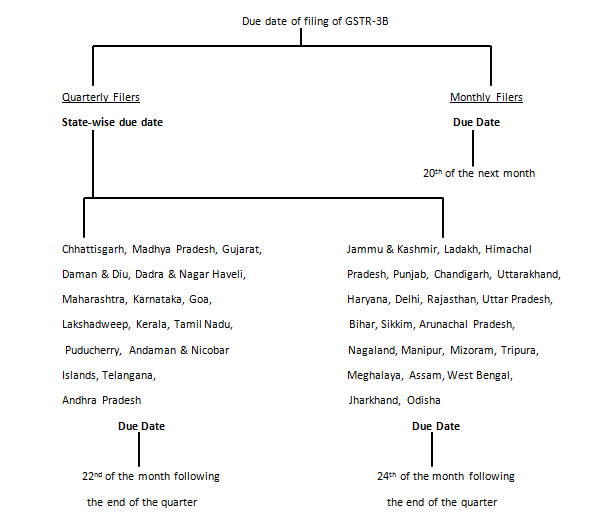

In case of regular taxpayers who have opted for QRMP (Quarterly Return Monthly Payment) scheme, GSTR-1 and GSTR-3B is to be filed on quarterly basis along with monthly payment of tax in Form PMT-06. Other Regular taxpayers have to file GSTR-1 and GSTR-3B on monthly basis. Regular taxpayers whose turnover in preceding financial year was upto Rs. 5 crores are eligible to opt for QRMP scheme.

Ans. Yes, a NIL return needs to filed even if there are no transactions during the tax period.

Ans. Late fees will be levied equal to Rs. 20 per day in case of NIL return and Rs. 50 per day in any other case. Also interest at the rate of 18% p.a. shall be charged if tax is not paid on time.

Ans. DSC of authorized signatory is required where the registered person is a company or LLP.

Ans. B2B means business to business. Here the customer is also registered under GST.

B2C Small means business to consumer transaction where customer is not registered under

GST.

B2C Large means business to consumer transaction where customer is not registered and also

the transaction involves inter-state supply and invoice value is more than Rs. 250000.

B2B and B2C Large invoices are reported invoice-wise in GSTR-1 whereas B2C Small Invoices are reported state-wise in GSTR-1.

Ans. There is no mechanism for filing a revised return be it GSTR-3B or GSTR-1 once it has been filed. However where any detail of B2B or B2C invoice or credit note has been incorrectly reported in GSTR-1, in that case amendment of incorrect details can be done in any subsequent GSTR-1.